Source: Compiled by CareEdge Ratings

India

healthysoch

New Delhi, May 19, 2025:

According to CareEdge Ratings, India’s orthopaedic and cardiac implant sector, including exports, which stood at ~$2.4 to $2.7 billion in FY24, is expected to reach ~$4.5 to $5.0 billion by FY28, driven by strong domestic demand and gradually growing export presence.

Foreign MNCs, with their long track record of safety and efficacy, have built trust among medical practitioners, which has led to their dominance in the Indian market. However, Indian implant manufacturers are making rapid strides in the domestic market and are gradually expanding their presence in the export market. CareEdge Ratings cited that with only 7.5% customs duty on the import of most coronary and orthopaedic implant products, any potential trade deal with the US resulting in tariff reduction is not likely to materially change the market dynamics for domestic manufacturers. However, material changes in non-tariff barriers, such as the relaxation of price caps, can significantly alter the competitive landscape for domestic manufacturers compared to MNCs.

Homegrown companies are gaining share and expanding in the export market

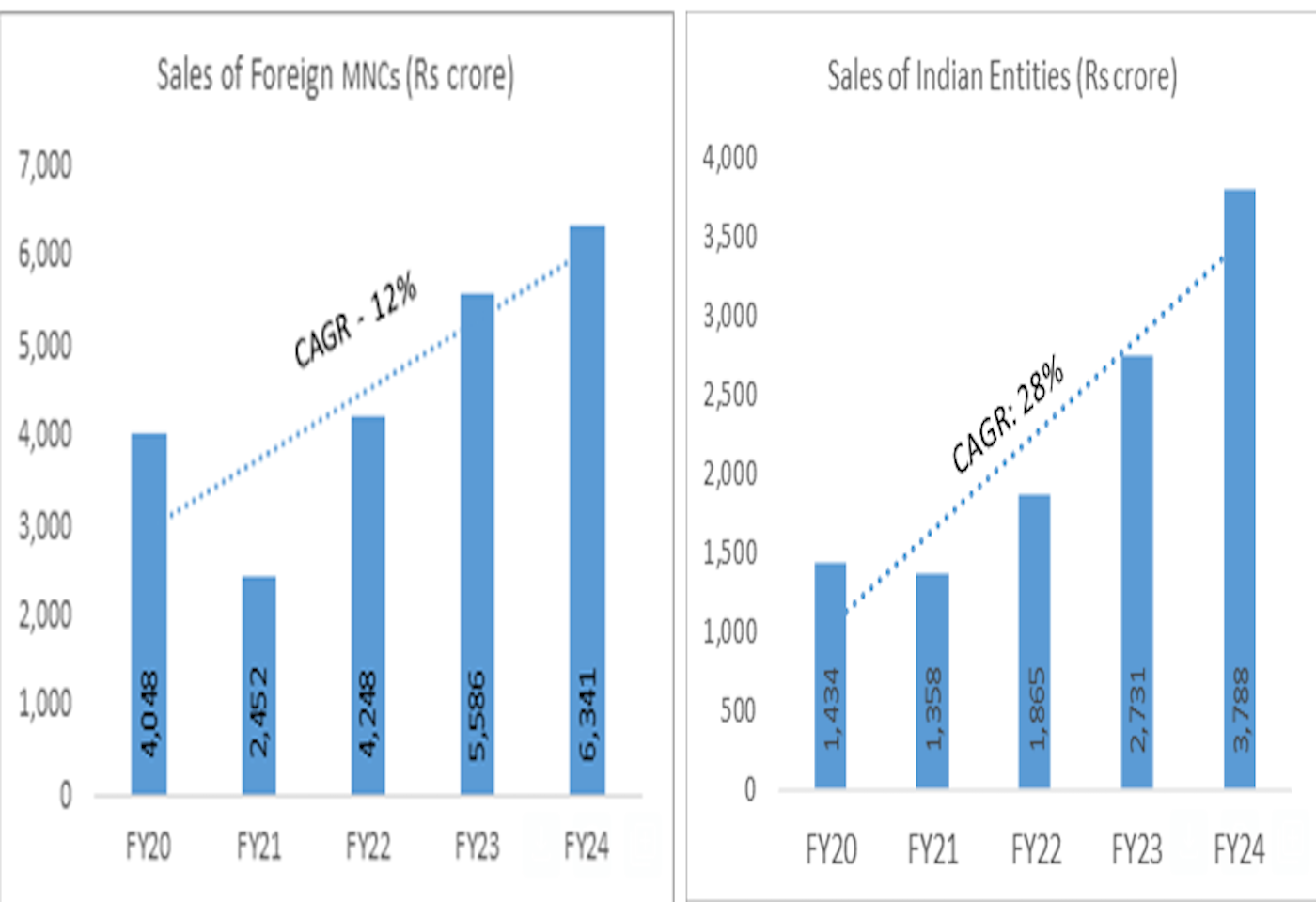

Foreign MNCs had a dominant market share of more than 90% in value terms in India’s orthopaedic and cardiac implant market during the pre-COVID period. However, India is gradually reducing its dependence on imports. Sales of homegrown implant manufacturers have grown at a compound annual growth rate (CAGR) of 28% (including a CAGR of 37% for exports) during the four years ended FY24, outpacing the sales CAGR of 12% for foreign multinational corporations (MNCs) during the same period. The sales volume growth of domestic entities was even higher, driven by their competitive pricing and increased participation in government-sponsored insurance schemes.

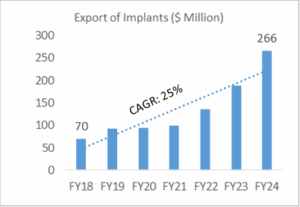

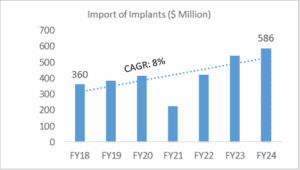

India’s export growth rate for implants has significantly outpaced the implant imports during the last 5-6 years.Demand tailwinds in the domestic market and huge export potential

India’s export growth rate for implants has significantly outpaced the implant imports during the last 5-6 years.Demand tailwinds in the domestic market and huge export potential

Increasing per capita income and affordability, rising healthcare awareness, an ageing population, expansion in healthcare infrastructure, and increasing insurance penetration are expected to drive the domestic demand for implants in the long term.

Penetrating the USA, the largest market for implants, remains key to long-term export growth potential. However, access to the USA market is challenging, as it requires extensive US-compliant clinical trials for large samples, which is a costly and time-consuming process. Additionally, the US market is fiercely competitive, with the presence of multiple large entities, and requires relationships with hospital procurement chains or GPOS (Group Purchasing Organisations), a local presence, and post-sale support.

Penetrating the USA, the largest market for implants, remains key to long-term export growth potential. However, access to the USA market is challenging, as it requires extensive US-compliant clinical trials for large samples, which is a costly and time-consuming process. Additionally, the US market is fiercely competitive, with the presence of multiple large entities, and requires relationships with hospital procurement chains or GPOS (Group Purchasing Organisations), a local presence, and post-sale support.

Source: Ministry of Chemicals and Fertilizer – Department of Pharmaceuticals – Annual Report 2024

Price caps limit margins, albeit increasing affordability and driving volume growth

Price caps adversely affected the foreign MNCs’ high-margin products, forcing them to discontinue some of their premium products from the Indian market. However, it significantly improved affordability, especially for implants manufactured by domestic companies, thereby enabling them to expand their market share. Schemes like Ayushman Bharat further improved the affordability and expanded the market.

The prices of knee implants are capped at approximately ~Rs 32,000 to ~ Rs 83,000, depending on the type and material used. Drug-eluting stents are capped at ~Rs 38,000, while bare metal stents have a ceiling price of ~Rs 10,500.

Krunal Modi, Director at CareEdge Ratings said “India’s medical implant sector is on a robust growth trajectory, driven by strong domestic demand and growing exports. India’s implant sector, including exports, is expected to reach ~$4.5 to $5.0 billion by FY28, registering an impressive CAGR of around 15-16%. Additionally, with supportive government policies and a growing healthcare infrastructure, the implant market is advancing towards ‘Atmanirbharta’.”